No one enjoys tax season and when you run a business, this season can quickly become a hectic blur of days. The key to handling your company’s taxes is to streamline processes and come up with faster methods for getting work done. From filing 1099s to finalizing every detail with the IRS, you need to work efficiently to ensure every deadline is met and no numbers were missed.

For many small business owners, the burden of tax season falls squarely on their shoulders. If that’s the case for you, check out these five time saving tips for your business during the upcoming tax season.

#1: Delegate Work When You Can

As a business owner, your life is busy and you probably have far too much on your plate to get done every day. Rather than stressing yourself out further during tax season, attempting to juggle your normal work alongside tax duties, work on delegating more. This is a great time of year to focus on finding your key team players and providing them with some of your burden.

The more you can delegate smaller tasks that don’t really require you, the more time you will have to dedicate to your taxes. While it can be hard to let go of things, it is wiser to hand off a few projects than to attempt to do it all. When you overwork yourself, it is easy to make more mistakes and to miss important tax deadlines. Turn your focus to where it needs to be and pass off some of your daily tasks.

#2: Push Back Projects That Aren’t Time Sensitive

Do you have some projects on your plate that aren’t time sensitive? Push back any tasks like these that you can until after you are finished with filing taxes. Tax forms come with deadlines, which means they need to take top priority over other projects.

Pushing back a few projects can free up your current schedule. This will allow you to dedicate the time you need to submitting tax forms on time. This will save you money in the long run as you will avoid costly tax fees and penalties.

#3: Schedule A Little Time Each Day

Tackling all your taxes in one day can be a bit overwhelming. Instead of staying at work for 15 hours straight attempting to get all your paperwork done at once, dedicate a chunk of time each day to the project. If you are at your best in the mornings, schedule yourself as busy for the first four hours of the day until you finish your taxes.

By approaching your taxes in chunks, you can save yourself from becoming completely exhausted by the process.

#4: Reach Out For Help

If you run into questions while you are filing your taxes and you are completely puzzled by a specific form, don’t hesitate to reach out for help. Talk to your accountant and be certain that you clearly understand applicable federal and local tax laws. This will save you from making costly mistakes and can ensure that you don’t lose sleep worrying about a form you didn’t understand.

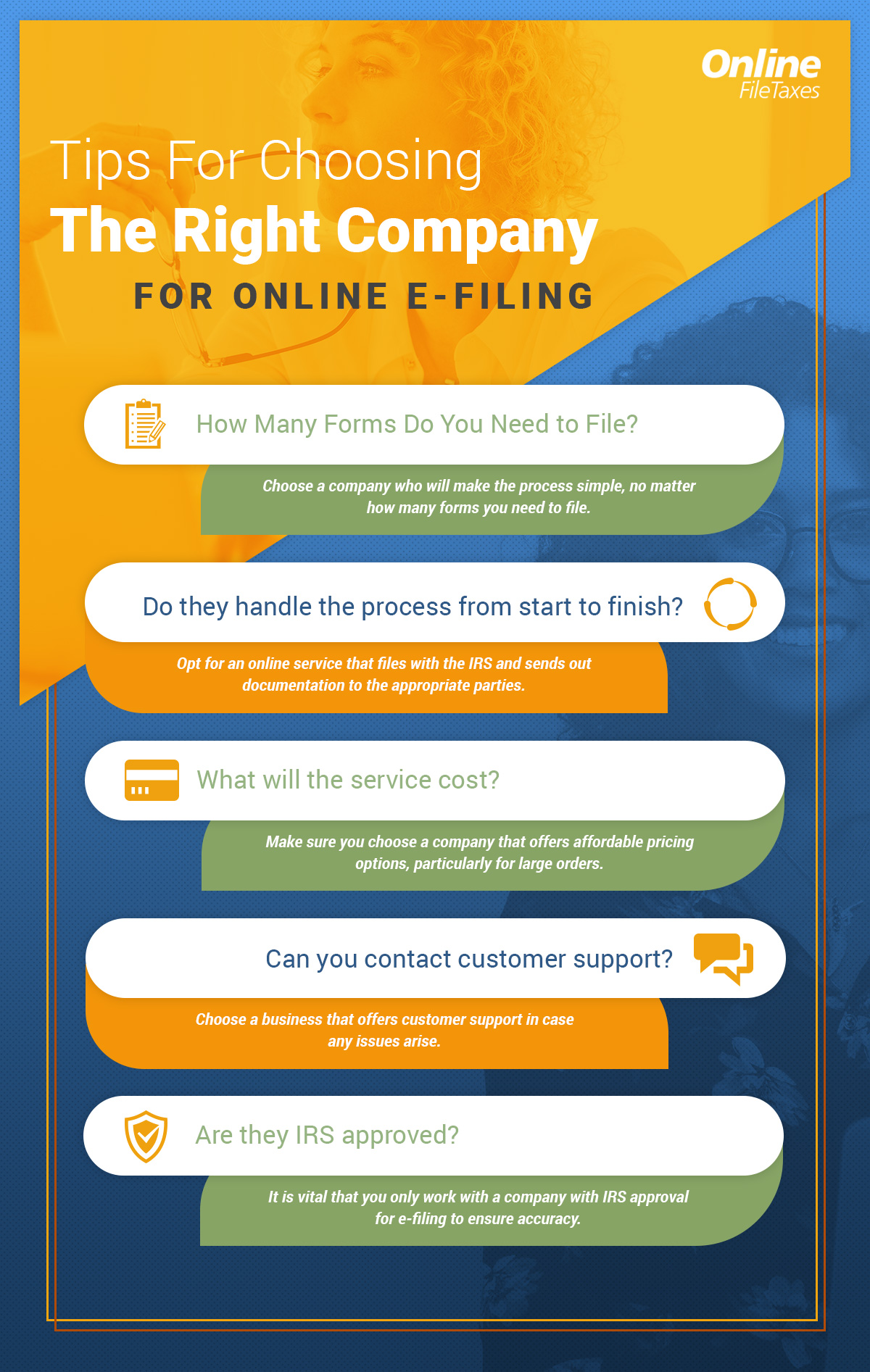

#5: Utilize E-Filing For 1099s

One of the most time-consuming projects in regards to taxes is filing 1099s. In the past, you had to purchase an array of lenghty forms, fill them out by hand, mail the appropriate document to recipients, and file with the IRS via snail mail. However, this process can be simplified by utilizing online e-filing for 1099s. This allows you to fill out the forms quickly and cuts out the long process of mailing forms by hand.

If you are interested in making the process of filing 1099s faster and easier, we invite you to sign up today for OnlineFileTaxes.com. You can quickly fill out any number of 1099s through our easy-to-use platform. The 1099s will be mailed out to the necessary recipients and you can also e-file with the IRS. Make this tax season a little easier on you and your staff by utilizing our simple process for 1099 filing. We look forward to helping you get your taxes done on time and with as little stress as possible.