A 1099 form is a tax form about which is little known by the average person. At OnlineFileTaxes.com, e-filing 1099 forms are our specialty. Often, professionals are burdened with having to file many different 1099 forms due to different forms of income over the tax year. With our reporting system, your 1099 forms can be automatically sent to the IRS for your convenience.

A 1099 form is a tax form about which is little known by the average person. At OnlineFileTaxes.com, e-filing 1099 forms are our specialty. Often, professionals are burdened with having to file many different 1099 forms due to different forms of income over the tax year. With our reporting system, your 1099 forms can be automatically sent to the IRS for your convenience.

The 1099 has quite a few different purposes. The first purpose is that of the independent contractor, which we’ve explored the details of in a previous blog post. Those who are self-employed or freelance are given 1099 forms by employers that pay them over a certain amount of money per tax year.

The 1099-MISC is used to signify income from such business ventures as rental properties, winnings from gambling and other lottery type contests, and other miscellaneous income.

Another type of the 1099 is the 1099-INT which specializes in reporting income earned from interest on interest earning checking accounts, savings bonds that you’ve redeemed, or savings accounts.

The 1099-C is for reporting cancelled debt. For example, if you’ve settled a debt for far less than the amount owed, you must file this form to report your savings to the IRS.

The form 1099-S is used for reporting money that you’ve earned from the sale of real estate.

The 1099-DIV is given to investors whose stocks and or bonds have paid out dividends over the tax year.

Another type of this form is the 1099-B which is used to report income acquired from the sale of stocks, bonds, and mutual funds.

The 1099-R is used for reporting monetary gain by way of IRA distributions, 401K liquidations, or pension payments.

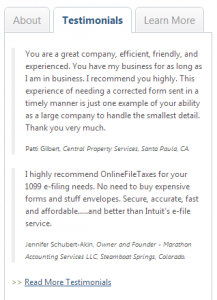

At OnlineFileTaxes.com we specialize in the e-filing of all the variations of 1099 forms. We also specialize in convenient e-filing of many other forms. For more information regarding our services provided, please visit our website.

Resources:

Online File Taxes

About.com

Just in time for the tax season Online File Taxes launches a new user friendly website!

Just in time for the tax season Online File Taxes launches a new user friendly website!