The January 31st deadline has passed for filing 1099 and W-2 forms to your employees, but you’ve still got some that haven’t been filed. So what happens now?

The January 31st deadline has passed for filing 1099 and W-2 forms to your employees, but you’ve still got some that haven’t been filed. So what happens now?

If you’ve forgotten to file, or simply become too bogged down with work to get all of your forms filed, there are penalties you will have to deal with. Within 30 days of the deadline, penalties will run about $30 per form that you haven’t filed or have incorrectly filed, with a maximum penalty of $250, 000 for larger businesses. If you’re running a small business, your maximum yearly penalty will be $75,000.

After 30 days, the penalties for not filing become much more expensive. With this set of penalties, you have until August 1 to file, but you will be charged $60 per correct return. The maximum charge for a large business is $500,000 and a small business is $200,000.

Once the August 1 deadline has passed, you’re looking at quite a costly endeavor. With fines weighing in at $100 per form and potential maximum penalties at $1.5 million for large businesses, this is absolutely a time sensitive situation. Even small businesses may have to deal with a maximum fine of $500,000, which has the potential to do serious damage to your bottom line.

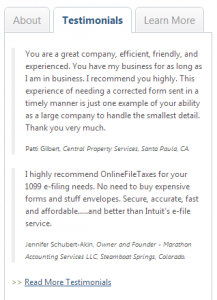

We can still help! Online File Taxes is set up to easily and efficiently process your 1099 and W-2 forms even after the deadline has passed. We can help you right your failure to file before it becomes too expensive to correct. Our system is simple and affordable, and we’ve got the ability to process hundreds of forms.

At Online File Taxes, we pride ourselves on being a one stop solution for your form filing needs. Stop by our website today and save yourself from harsh penalties!