If you are a small business owner, then odds are good you wear a million hats. Operating a small business requires hard work and a lot of focus. From ensuring day-to-day operations are running smoothly to handling big picture items, such as the future goals of your business, it is no easy feat to effectively manage your small business. One big task that many small business owners loathe but is a necessary evil is correctly filing taxes. For small business owners, tax season can be a flurry of activity and can begin to feel downright chaotic.

Before tax season is fully upon us, take the time to consider the following tips that will help you prepare. Here at OnlineFileTaxes.com, we make it easy to file 1099s through our online platform. Read on to find out how this, as well as our other tips and tricks, can make your life easier in the 2019 tax season.

Get Organized Early

When it comes to filing taxes, the more organized you are, the better. Make sure that from the start you are keeping everything you will need organized. Do you find yourself simply throwing receipts and paperwork into a pile on your desk? Do you have a filing cabinet that is overflowing with papers that are haphazardly organized? Take the time to straighten out all your paperwork and set in place a system to keep things in order.

Due to the amount of paperwork you will undoubtedly have as a small business, it is wise to turn as much of your paperwork into digital documents as possible. Storing your information in a digital format will make it easier to stay organized and prevents you from drowning in a sea of papers. Make sure that you keep everything in an order that is simple for you to weed through later. For example, all your receipts should be kept in one location, sorted by date. If you have employed contractors, freelancers, or other non-employee workers, store all their information in one easy-to-access location. Whether you keep hard copies of everything on hand or you store things online, make sure your system is simple and easily navigable. By keeping your paperwork organized throughout the year, you can save yourself from a massive headache when tax season is in full swing.

Be Sure You Understand Your Responsibilities

Taxes for small business owners can be a confusing thing. There are a myriad of complexities surrounding what you need to file and what you will owe. If you are not an expert in taxes, take the time to learn more so you are confident that you know your responsibilities come tax season. Reach out to a local CPA to get advice or spend a day researching on your own. Create a list of questions you have or areas of confusion. Dig until you find the answers you need.

In many cities, local libraries will offer free tax services where you can meet one-on-one with a tax expert. Bring in a list of questions and find out everything you need to know long before tax season arrives. This will help you better prepare ahead of time and will prevent you from feeling at a complete loss when your taxes are due. By ensuring you understand your responsibilities, you can save yourself time and money in the long run.

Tackle Projects In Steps

Filing taxes as a small business owner can feel like an overwhelming task. If you are staring at mounds of paperwork in your office and you realize you have a ton of research to do before you are equipped to file your taxes properly, take a deep breath and bite off small pieces of the project at a time. Instead of spending a whole day drowning in receipts, tax forms, and paperwork, block out small chunks of time each day for a week to handle one component of the project.

For example, one day you can spend a few hours organizing all your receipts. Another day you might spend doing research on local laws for filing taxes as a small business owner. By tackling the project in steps, the task will be less overwhelming and you will be less frazzled leading to fewer mistakes.

Streamline The Filing Process

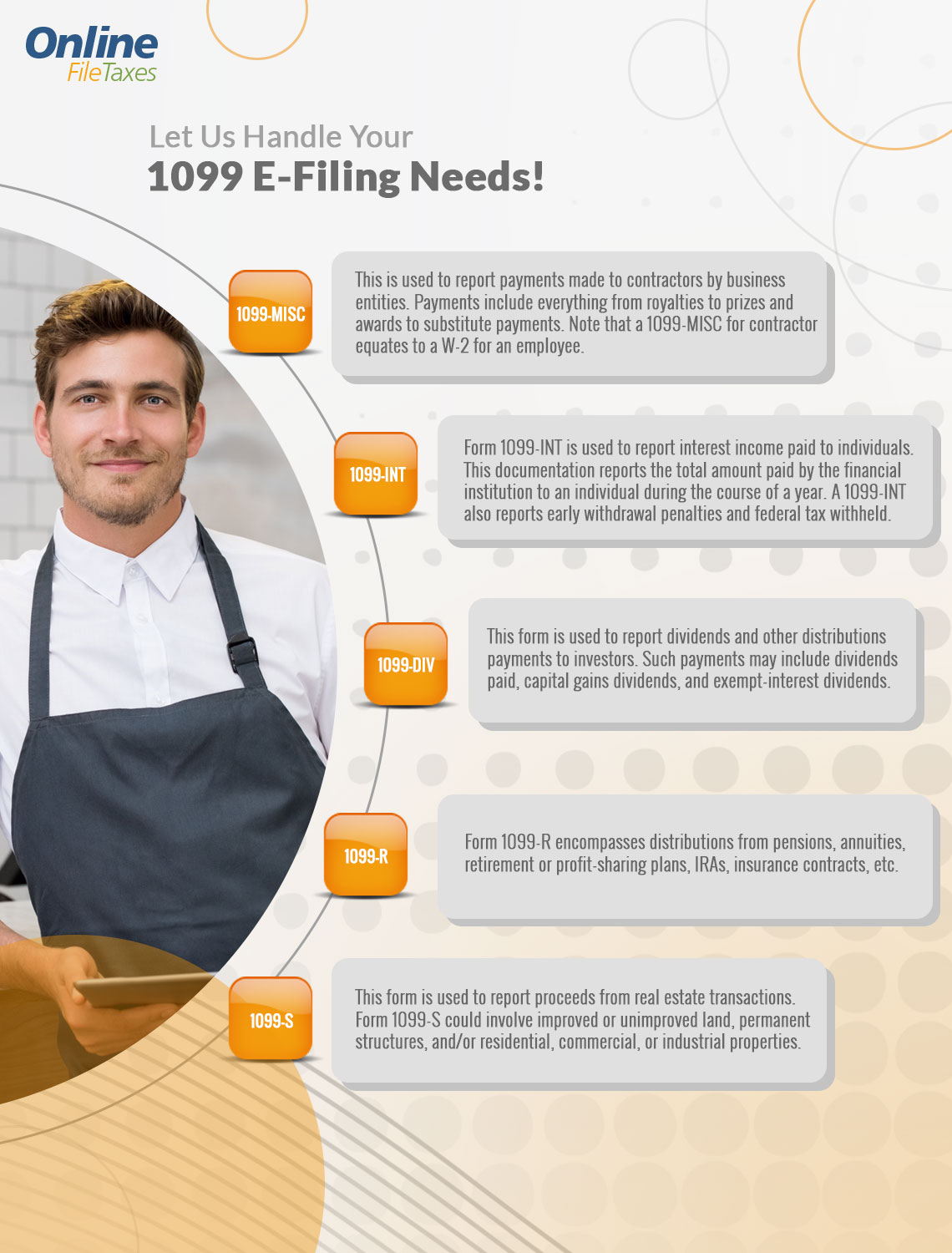

The good news is that with the advent of technology, a lot of tasks that were once manual and time-consuming can now be streamlined. If you can improve your efficiency by utilizing online tools, by all means, do so! For example, 1099s for small business owners can all be filed online through our service at OnlineFileTaxes.com. Instead of downloading and printing out dozens of 1099s and then manually filing them with the IRS, you can quickly do it all through our online portal. Once you fill out the information online, the 1099s will automatically be filed with the IRS electronically for you. You will receive a copy of the form for your own records, which will be easy to access online at any time. The 1099 will also be automatically mailed out to the appropriate recipient, saving you yet another step.

By utilizing efficient technologies, such as OnlineFileTaxes.com, you can save yourself an immense amount of time and hassle. Instead of being buried in paperwork, spending hours upon hours filling out lengthy forms, you can quickly accomplish the task, freeing your time for other important pressing matters. As a small business owner, your time is invaluable, so be sure to implement as many streamlined methods for tax filing as you possibly can.

Assess For Next Year

Finally, take the time after you are finished with tax season to assess what could be done better next year. Did you struggle with organization, making it difficult to find the paperwork you needed when it came time to file your taxes? Did you make the mistake of manually filing all your 1099s, creating a headache? Take note of any areas you could improve in and set up a better system for the following year.

Interested in making the process of filing 1099s simple? Sign up to utilize OnlineFileTaxes.com today and save yourself time and money. With our easy-to-use platform, you can file all your 1099s in no time at all from the comfort of your computer.